In Barrie, Ontario, online payday loans provide a convenient and accessible financial option for individuals seeking immediate cash for unexpected expenses or emergencies. While these loans offer quick approval and convenience, they also come with significant costs and considerations that borrowers should understand before proceeding. This article delves into how online payday loans work, their associated fees, regulations, and alternative financial solutions available for payday loans in Barrie.…

In Barrie, Ontario, online payday loans provide a convenient and accessible financial option for individuals seeking immediate cash for unexpected expenses or emergencies. While these loans offer quick approval and convenience, they also come with significant costs and considerations that borrowers should understand before proceeding. This article delves into how online payday loans work, their associated fees, regulations, and alternative financial solutions available for payday loans in Barrie.…

Payday Loan Usage in Saskatoon, Saskatchewan On The Rise

In recent years, Saskatoon, Saskatchewan, has seen a significant increase in the usage of payday loans. These short-term, high-interest loans are often used by individuals who are facing financial difficulties and need quick access to cash. While payday loans can provide temporary relief, they often come with high fees and interest rates that can trap borrowers in a cycle of debt.

In recent years, Saskatoon, Saskatchewan, has seen a significant increase in the usage of payday loans. These short-term, high-interest loans are often used by individuals who are facing financial difficulties and need quick access to cash. While payday loans can provide temporary relief, they often come with high fees and interest rates that can trap borrowers in a cycle of debt.

One of the main drivers behind the rise in payday loan usage in Saskatoon is the challenging economic environment. Like many other parts of Canada, Saskatoon has experienced rising costs of living, including housing, food, and utilities.…

Naturopathic Medicine and Preventative Healthcare: A Proactive Approach

Naturopathic medicine is a form of complementary and alternative medicine (CAM) that emphasizes a proactive approach to healthcare and the prevention of illness. It is based on the belief that the body has an innate ability to heal itself when given the right conditions and support. Naturopathic doctors (NDs) at this Naturopath – Active Care Health Centre use a combination of traditional healing practices, natural therapies, and modern medical science to promote overall well-being and prevent disease.…

Naturopathic medicine is a form of complementary and alternative medicine (CAM) that emphasizes a proactive approach to healthcare and the prevention of illness. It is based on the belief that the body has an innate ability to heal itself when given the right conditions and support. Naturopathic doctors (NDs) at this Naturopath – Active Care Health Centre use a combination of traditional healing practices, natural therapies, and modern medical science to promote overall well-being and prevent disease.…

How to Consolidate Debt and Regain Financial Control

In the ever-evolving landscape of personal finance, learning to consolidate debt can be a daunting task. Many individuals find themselves juggling various loans and credit card balances, leading to a never-ending cycle of high-interest payments. Fortunately, there is a way out of this financial quagmire through a process known as debt consolidation.

In the ever-evolving landscape of personal finance, learning to consolidate debt can be a daunting task. Many individuals find themselves juggling various loans and credit card balances, leading to a never-ending cycle of high-interest payments. Fortunately, there is a way out of this financial quagmire through a process known as debt consolidation.

Debt consolidation is a financial strategy that involves merging multiple debts into a single, more manageable loan. This can be a powerful tool for regaining control of your finances and working towards a debt-free future. In this article, we will delve into the details of how to consolidate debt effectively.…

Dealing With Debt In Canada After Job Loss

Losing a job can be a devastating experience, and it often leads to financial difficulties for individuals and families. In Canada, dealing with debt after job loss requires careful planning and resourcefulness. I will provide an overview of debt relief strategies and resources available to Canadians facing debt after job loss.

Losing a job can be a devastating experience, and it often leads to financial difficulties for individuals and families. In Canada, dealing with debt after job loss requires careful planning and resourcefulness. I will provide an overview of debt relief strategies and resources available to Canadians facing debt after job loss.

The first step in dealing with debt after job loss is to assess one’s financial situation. This includes taking stock of all debts, such as credit card balances, mortgages, and loans. It is important to have a clear understanding of the total amount owed, interest rates, and minimum monthly payments. This information will help create a realistic budget and identify areas for potential savings.…

Looking For Free Debt Consolidation Advice

Free Canadian debt consolidation advice is available from different sources. Debt consolidation helps you cope with debt problems with no filing for bankruptcy or even giving up your property. The debt consolidation help you place your credit report back in order. Numerous people are skeptical about debt consolidation, thinking it will put them into additional trouble. Canadian debt consolidation is an authorized way of repaying debts and is permitted in all Canadian provinces and territories as well.…

Free Canadian debt consolidation advice is available from different sources. Debt consolidation helps you cope with debt problems with no filing for bankruptcy or even giving up your property. The debt consolidation help you place your credit report back in order. Numerous people are skeptical about debt consolidation, thinking it will put them into additional trouble. Canadian debt consolidation is an authorized way of repaying debts and is permitted in all Canadian provinces and territories as well.…

Dumbing Down On Debts

Source https://credit-consolidation.ca/ – Everybody has seen the tv commercials featuring slogans like “Buy now spend later,” and the like. You don’t have to spend your cash to purchase that brand new automobile, a wide-screen TV, that newest cell phone, or a vacation on a tropical island when you are able to get all of these items today. A pattern of immediate gratification is extremely expensive ; One which can take you to a lifetime of financial hurdles.

Source https://credit-consolidation.ca/ – Everybody has seen the tv commercials featuring slogans like “Buy now spend later,” and the like. You don’t have to spend your cash to purchase that brand new automobile, a wide-screen TV, that newest cell phone, or a vacation on a tropical island when you are able to get all of these items today. A pattern of immediate gratification is extremely expensive ; One which can take you to a lifetime of financial hurdles.

In some instances, there’re deceptive claims made in the marketing. One I viewed read, “Helping you to get ahead.” With such a slogan, you might believe the credit card business could well be indulging in some sort of favor with the customers, but that isn’t the case at all.…

Ways To Help Control Financial Obligations

Unemployment has a practice to bring negative consequences and the majority of them are related to economic insufficiency. In order to control the obligations, you are taking loans for unemployed, though the reality is, after enrolling in a loan, you’ve to settle it. This once again demands cash.

Unemployment has a practice to bring negative consequences and the majority of them are related to economic insufficiency. In order to control the obligations, you are taking loans for unemployed, though the reality is, after enrolling in a loan, you’ve to settle it. This once again demands cash.

Are you going to take another mortgage to repay the prior one? Definitely not. You have to make several arrangements to make sure that the repayments go promptly and don’t impact the credit efficiency of yours. A single missed repayment is able to create imbalance in the life of yours. After you’re trapped in these kinds of difficulties, the comeback becomes incredibly hard.…

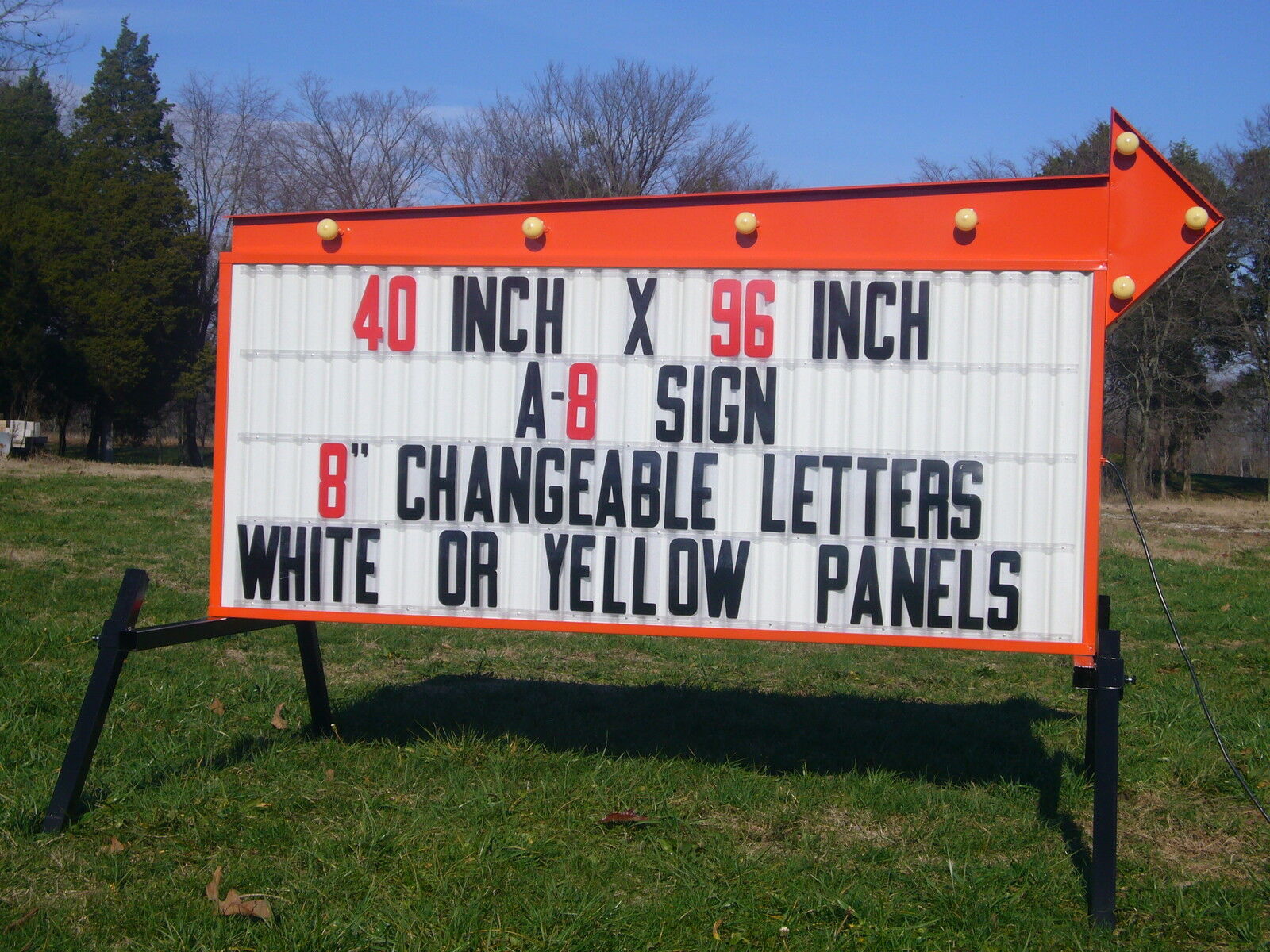

Signs Of Business Success

From business signs Kelowna – On the list of huge mistakes many small businesses make is misunderstanding the causes for the failure of the advertising of theirs. It is undeniable most small business marketing does not work, though the causes aren’t always clear on the business people themselves.

From business signs Kelowna – On the list of huge mistakes many small businesses make is misunderstanding the causes for the failure of the advertising of theirs. It is undeniable most small business marketing does not work, though the causes aren’t always clear on the business people themselves.

Many business people rely on newspaper advertising and marketing. They place an advertisement in the regional paper (or maybe a professional magazine in case they are a professional company) then scratch the heads of theirs whenever they do not get some revenue. Chances are they determine that advertising does not work, when the actual problem isn’t the advertising generally, though the specific kind of advertising they are doing. In a nutshell, they are performing it totally wrong, primarily since they normally use “branding” marketing, meaning a logo and a slogan, as they might get far better outcomes by doing things differently.…

Tips To Clear The Credit Card Dues

From Debt Consolidation Alberta – most people are familiar with these two terms – credit and debit in the banking terminology. Credit can be defined as the ability of the customer or the person to obtain their needs like good and services. The credit of the customer can be treated to take before payment is done. Clearly, it is the debt amount issued by the concerned bank. Taking credit is just one part of the dealing but repaying the credit as per the stipulated time frame is also very important else you would fall in a defaulter list. How to deal with credit card is an important issue in every individual person’s life. Let’s discuss that more at Debt Consolidation Alberta…

From Debt Consolidation Alberta – most people are familiar with these two terms – credit and debit in the banking terminology. Credit can be defined as the ability of the customer or the person to obtain their needs like good and services. The credit of the customer can be treated to take before payment is done. Clearly, it is the debt amount issued by the concerned bank. Taking credit is just one part of the dealing but repaying the credit as per the stipulated time frame is also very important else you would fall in a defaulter list. How to deal with credit card is an important issue in every individual person’s life. Let’s discuss that more at Debt Consolidation Alberta…

Start The Journey To A Healthy Lifestyle

Going green appears to be a staple in advertising circles nowadays. Items are showing a lot more plus more eco friendly coloring in their labels.’ Earth-friendly’ and’ eco-friendly’ are advertising buzzwords. And grassroots movements for regional consumables is gaining momentum. together with the regular barrage of advertising materials pushing’ green’, it is able to border on obnoxious. There are always solutions to clean up our planet, learn more about this from Kelowna concrete…

Going green appears to be a staple in advertising circles nowadays. Items are showing a lot more plus more eco friendly coloring in their labels.’ Earth-friendly’ and’ eco-friendly’ are advertising buzzwords. And grassroots movements for regional consumables is gaining momentum. together with the regular barrage of advertising materials pushing’ green’, it is able to border on obnoxious. There are always solutions to clean up our planet, learn more about this from Kelowna concrete…

Never Neglect Your Familys Dental Health

Would you realize that dental health is something which shouldn’t be neglected? A lot more than nearly anything else, dental health must be treated as a high priority. Smiling could be an extremely crucial part of the life of ours. Nevertheless, a selection of oral diseases could be pretty devastating. These diseases are able to cause discomfort and pain. As a result, everyone should be worried about the teeth of theirs and the way to effectively look after it.

Would you realize that dental health is something which shouldn’t be neglected? A lot more than nearly anything else, dental health must be treated as a high priority. Smiling could be an extremely crucial part of the life of ours. Nevertheless, a selection of oral diseases could be pretty devastating. These diseases are able to cause discomfort and pain. As a result, everyone should be worried about the teeth of theirs and the way to effectively look after it.

In selecting a local dentist, it’s crucial that you’re feeling comfortable with the individual. It’s additionally beneficial in case the dentist that you select manages the remainder of your family members too. Consequently, instead of getting an individual dentist, it’s more helpful to select one for the entire family. …

Having My Closet Organized Is Very Important

Creating an organized closet is really important; we want a closet system which makes the lives of ours easier to handle. We need a closet that is particularly designed for each of the specific needs of ours. Because all of us employ the closets of ours differently, a properly created customized storage and organized closet help make the bedrooms of ours, garages, homes, plus kitchens tidier and quicker to handle on everyday basis. Bottom line -custom organization methods save us energy and time by allowing us to get into the things of ours quickly, and eliminate clutter from around the houses of ours. Whenever we see the closets of ours assembled and tidy, with every thing in the correct place of its, we feel calm and also relaxed. …

Creating an organized closet is really important; we want a closet system which makes the lives of ours easier to handle. We need a closet that is particularly designed for each of the specific needs of ours. Because all of us employ the closets of ours differently, a properly created customized storage and organized closet help make the bedrooms of ours, garages, homes, plus kitchens tidier and quicker to handle on everyday basis. Bottom line -custom organization methods save us energy and time by allowing us to get into the things of ours quickly, and eliminate clutter from around the houses of ours. Whenever we see the closets of ours assembled and tidy, with every thing in the correct place of its, we feel calm and also relaxed. …

Spring Is Here, Time To get In Shape

In the event it comes to getting fit, nearly all individuals at one time or even another decide they wish to exercise more and consume less so that they look, feel, and also perform much better. The purchase and gym memberships of costly fitness gear rise in January annually as individuals make resolutions to ultimately shed those additional weight as well as tone up the systems of theirs.

In the event it comes to getting fit, nearly all individuals at one time or even another decide they wish to exercise more and consume less so that they look, feel, and also perform much better. The purchase and gym memberships of costly fitness gear rise in January annually as individuals make resolutions to ultimately shed those additional weight as well as tone up the systems of theirs.

Just like all great intentions, nonetheless, very a lot of these well-meaning people never ever achieve the fitness goals of theirs. Why? You will find a selection of reasons, though I’m going to highlight some of the most common.…